HDFC Life Insurance Company Ltd

NSE :HDFCLIFE BSE :540777 Sector : InsuranceBuy, Sell or Hold HDFCLIFE? Ask The Analyst

BSE

Apr 22, 00:00

712.55

0.55 (0.08%)

prev close

712.00

OPEN PRICE

715.60

volume

38945

Today's low / high

709.10 / 722.35

52 WK low / high

511.10 / 760.95

bid price (qty)

0 (0)

offer price (qty)

0 (0)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 22 Apr 712.55 (0.05%) | 21 Apr 712.20 (-1.09%) | 17 Apr 720.05 (0.56%) | 16 Apr 716.05 (1.61%) | 15 Apr 704.70 (2.79%) | 11 Apr 685.55 (0.11%) | 09 Apr 684.80 (-0.14%) | 08 Apr 685.75 (2.97%) | 07 Apr 665.95 (-3.35%) | 04 Apr 689.05 (-0.56%) | 03 Apr 692.90 (-0.47%) | 02 Apr 696.15 (0.47%) | 01 Apr 692.90 (1.05%) | 28 Mar 685.70 (0.56%) | 27 Mar 681.90 (2.02%) | 26 Mar 668.40 (-0.70%) | 25 Mar 673.10 (-1.00%) | 24 Mar 679.90 (0.04%) | 21 Mar 679.60 (0.78%) | 20 Mar 674.35 (1.47%) | 19 Mar 664.55 (3.75%) |

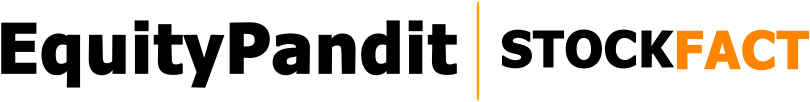

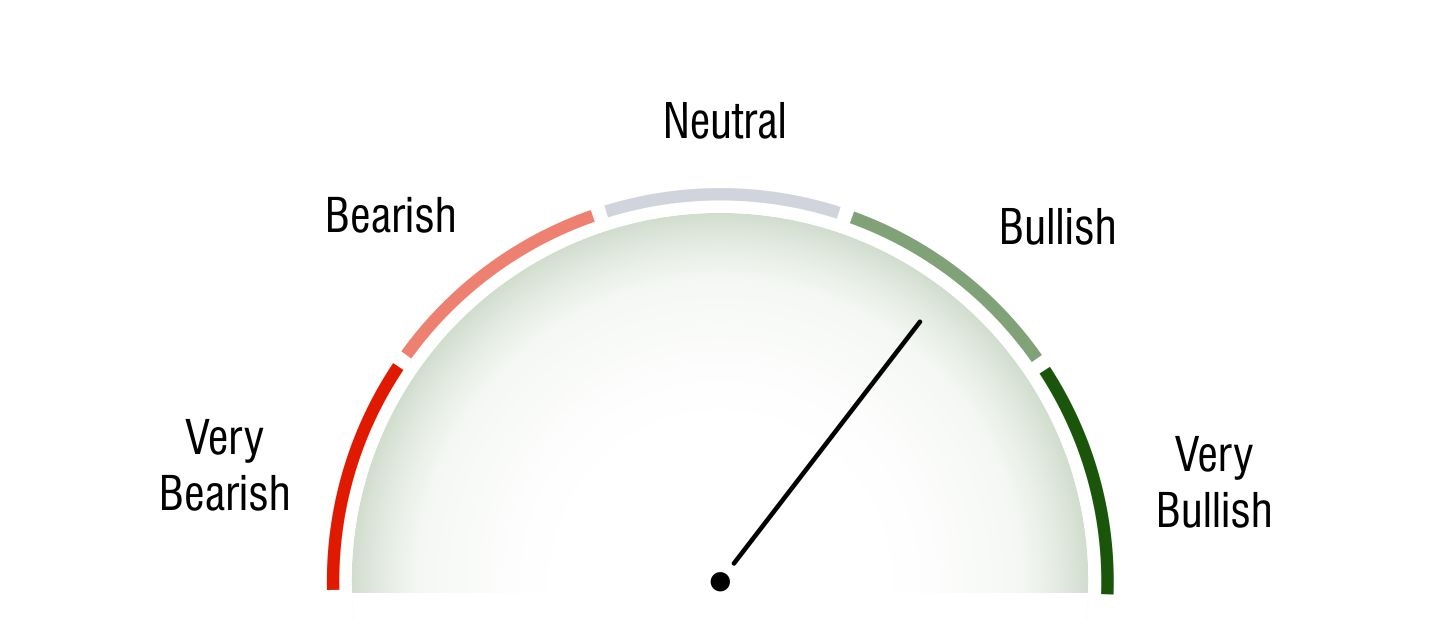

Technical Analysis

Short Term Investors

Bullish

Medium Term Investors

Very Bullish

Long Term Investors

Neutral

Moving Averages

5 DMA

Bearish

713.03

10 DMA

Bullish

697.71

20 DMA

Bullish

690.03

50 DMA

Bullish

651.6

100 DMA

Bullish

639.8

200 DMA

Bullish

670.06

Intraday Support and Resistance

(Based on Pivot Points) undefined | BSE : 712.55

Updated On Apr 22, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 733.39 | 727.62 | 716.21 | - | - |

| R2 | 727.62 | 722.54 | 714.99 | 727.18 | - |

| R1 | 720.09 | 719.4 | 713.77 | 719.21 | 723.85 |

| P | 714.32 | 714.32 | 714.32 | 713.88 | 716.2 |

| S1 | 706.79 | 709.24 | 711.33 | 705.91 | 710.55 |

| S2 | 701.02 | 706.1 | 710.11 | 700.58 | - |

| S3 | 693.49 | 701.02 | 708.89 | - | - |

Key Metrics

EPS

8.37

P/E

85.13

P/B

9.51

Dividend Yield

0.29%

Market Cap

1,53,411 Cr.

Face Value

10

Book Value

74.9

ROE

11.38%

EBITDA Growth

499.43 Cr.

Debt/Equity

0.07

Shareholding History

Quarterly Result (Figures in Rs. Crores)

HDFC Life Insurance Company Ltd Quaterly Results

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | ||

| INCOME | 28215.61 | 27023.49 | 28776.43 | 17270.97 | 24314.21 | |

| PROFIT | 411.64 | 478.97 | 435.18 | 421.31 | 475.36 | |

| EPS | 1.91 | 2.23 | 2.02 | 1.96 | 2.21 |

HDFC Life Insurance Company Ltd Quaterly Results

| Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | Mar 2025 | ||

| INCOME | 28148.28 | 26964.33 | 28709.39 | 17185.92 | 24210.43 | |

| PROFIT | 411.66 | 477.65 | 432.99 | 414.94 | 476.54 | |

| EPS | 1.91 | 2.22 | 2.01 | 1.93 | 2.21 |

Profit & Loss (Figures in Rs. Crores)

HDFC Life Insurance Company Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 27293.93 | 18248.23 | 30785.59 | 32541.59 | 38878.93 | 29748.96 | 71973.08 | 67891.6 | 71644.4 | 102006.61 | |

| PROFIT | 785.51 | 816.79 | 886.92 | 1107.2 | 1180.79 | 1297.44 | 1360.87 | 1326.93 | 1368.28 | 1574.08 | |

| EPS | 0 | 0 | 0 | 5.5 | 6.33 | 6.43 | 6.73 | 6.28 | 6.37 | 7.32 |

HDFC Life Insurance Company Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 27291.54 | 18535.85 | 30781.28 | 32527.34 | 38866.02 | 29717.8 | 71889.38 | 66147.75 | 71488.35 | 101789.5 | |

| PROFIT | 785.51 | 818.4 | 892.13 | 1109 | 1276.79 | 1295.27 | 1360.1 | 1207.69 | 1360.13 | 1568.86 | |

| EPS | 3.94 | 4.1 | 4.46 | 5.51 | 6.33 | 6.42 | 6.73 | 5.72 | 6.33 | 7.29 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 2,150.94 | 2,149.4 | 2,112.62 | 2,020.94 | 2,018.8 | 2,017.38 | 2,011.74 | 1,998.48 | 1,995.29 | 1,994.88 |

| Reserves Total | 12,515.41 | 10,840.59 | 13,497.39 | 6,616.88 | 4,782.23 | 3,624.83 | 2,692.48 | 1,827.84 | 1,108.2 | 546.4 |

| Equity Application Money | 0 | 3.15 | 3.32 | 1.97 | 5.59 | 0.39 | 0.89 | 0 | 0 | 0 |

| Total Shareholders Funds | 14,666.35 | 12,993.14 | 15,613.33 | 8,639.79 | 6,806.62 | 5,642.6 | 4,705.11 | 3,826.32 | 3,103.49 | 2,541.28 |

| Unsecured Loans | 950 | 950 | 600 | 600 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Loan Funds | 950 | 950 | 600 | 600 | 0 | 0 | 0 | 0 | 0 | 0 |

| Policy Holders Fund | 0 | 0 | 0 | 0 | 0 | 1,19,254.4 | 0 | 0 | 0 | 0 |

| Other Liabilities | 2,78,228.39 | 2,25,757.61 | 2,07,573.36 | 1,63,881.41 | 1,20,427.3 | 0 | 1,01,126.93 | 87,448.11 | 70,886.75 | 64,724.95 |

| Total Liabilities | 2,93,844.74 | 2,39,700.75 | 2,23,786.69 | 1,73,121.2 | 1,27,233.92 | 1,24,897 | 1,05,832.04 | 91,274.43 | 73,990.24 | 67,266.23 |

| APPLICATION OF FUNDS : | ||||||||||

| Loan / Non-Current Assets | 0 | 0 | 0 | 0 | 0 | 0 | 18.74 | 47.85 | 93.07 | 125.64 |

| Gross Block | 2,244.57 | 1,660.99 | 7,231.23 | 1,056.6 | 769.32 | 780.96 | 717.62 | 681.33 | 648.36 | 628.94 |

| Less: Accumulated Depreciation | 695.58 | 663.79 | 625.99 | 471.92 | 447.02 | 410.8 | 381.2 | 343.96 | 313.16 | 282.91 |

| Net Block | 1,548.99 | 997.2 | 6,605.24 | 584.68 | 322.3 | 370.16 | 336.42 | 337.37 | 335.2 | 346.03 |

| Capital Work in Progress | 27.67 | 30.79 | 19.8 | 14.24 | 8.41 | 10.19 | 5.28 | 16.09 | 12.16 | 6.44 |

| Investments | 2,91,127.93 | 2,38,197.1 | 2,16,550.64 | 1,73,563.57 | 1,27,255.71 | 1,24,957.97 | 1,06,589.88 | 91,723.43 | 74,143.68 | 67,023.56 |

| Sundry Debtors | 0 | 0 | 0 | 0 | 0 | 205.5 | 0 | 0 | 0 | 0 |

| Cash and Bank Balance | 1,558.61 | 1,168.55 | 1,375.15 | 1,099.26 | 690.75 | 1,244.45 | 1,110.5 | 797.38 | 727.39 | 572.5 |

| Loans and Advances | 6,526.54 | 6,090.3 | 4,911.68 | 3,969.24 | 3,647.63 | 3,199.02 | 2,422.01 | 2,174.44 | 1,232.88 | 1,234.35 |

| Total Current Assets | 8,085.15 | 7,258.85 | 6,286.83 | 5,068.5 | 4,338.37 | 4,648.96 | 3,532.51 | 2,971.82 | 1,960.27 | 1,806.85 |

| Current Liabilities | 8,728.61 | 8,240.29 | 6,836 | 6,440.04 | 4,913.88 | 5,064.69 | 4,606.7 | 3,775.32 | 2,512.54 | 2,009.09 |

| Provisions | 113.59 | 128.21 | 111.76 | 93.79 | 76.05 | 58.71 | 44.09 | 46.82 | 41.6 | 33.2 |

| Total Current Liabilities & Provisions | 8,842.21 | 8,368.5 | 6,947.76 | 6,533.84 | 4,989.93 | 5,123.41 | 4,650.78 | 3,822.14 | 2,554.14 | 2,042.29 |

| Net Current Assets | -757.06 | -1,109.66 | -660.93 | -1,465.34 | -651.56 | -474.44 | -1,118.28 | -850.32 | -593.87 | -235.44 |

| Other Assets | 1,897.22 | 1,585.31 | 1,271.93 | 424.05 | 299.05 | 79.59 | 0 | 0 | 0 | 0 |

| Total Assets | 2,93,844.74 | 2,39,700.74 | 2,23,786.69 | 1,73,121.2 | 1,27,233.91 | 1,24,897 | 1,05,832.03 | 91,274.43 | 73,990.24 | 67,266.23 |

| Contingent Liabilities | 2,133.04 | 910.08 | 1,482.98 | 1,856.9 | 2,189.66 | 1,530.62 | 827.9 | 665.73 | 100.27 | 176.16 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Share Capital | 2,150.94 | 2,149.4 | 2,112.62 | 2,020.94 | 2,018.8 | 2,017.38 | 2,011.74 | 1,998.48 | 1,995.29 | 1,994.88 |

| Reserves Total | 12,500.8 | 10,834.26 | 13,369.97 | 6,614.81 | 4,775.53 | 3,637.87 | 2,706.4 | 1,840.2 | 1,113.31 | 546.97 |

| Equity Application Money | 0 | 3.15 | 3.32 | 1.97 | 5.59 | 0.39 | 0.89 | 0 | 0 | 0 |

| Total Shareholders Funds | 14,651.74 | 12,986.81 | 15,485.91 | 8,637.72 | 6,799.92 | 5,655.64 | 4,719.03 | 3,838.68 | 3,108.6 | 2,541.85 |

| Unsecured Loans | 950 | 950 | 600 | 600 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Loan Funds | 950 | 950 | 600 | 600 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Liabilities | 2,78,127.58 | 2,25,682.34 | 1,88,074.63 | 1,63,828.11 | 1,20,385.53 | 1,19,227.26 | 1,01,116.04 | 87,447.34 | 70,886.75 | 64,724.95 |

| Total Liabilities | 2,93,729.32 | 2,39,619.15 | 2,04,160.54 | 1,73,065.83 | 1,27,185.45 | 1,24,882.9 | 1,05,835.07 | 91,286.02 | 73,995.35 | 67,266.8 |

| APPLICATION OF FUNDS : | ||||||||||

| Loan / Non-Current Assets | 0 | 0 | 0 | 0 | 0 | 0 | 18.74 | 47.85 | 93.07 | 125.64 |

| Gross Block | 2,236.23 | 1,656.14 | 1,422.43 | 1,053.72 | 766.62 | 732.03 | 715.78 | 679.49 | 646.55 | 627.89 |

| Less: Accumulated Depreciation | 691.14 | 660.25 | 458.19 | 469.57 | 444.91 | 408.92 | 379.65 | 342.67 | 312.37 | 282.43 |

| Net Block | 1,545.09 | 995.89 | 964.24 | 584.15 | 321.71 | 323.11 | 336.13 | 336.82 | 334.18 | 345.46 |

| Capital Work in Progress | 27.06 | 29.96 | 19.4 | 13.39 | 8.41 | 10.19 | 5.28 | 16.09 | 12.16 | 6.44 |

| Investments | 2,91,063.77 | 2,38,136.27 | 2,03,529.51 | 1,73,582.05 | 1,27,226.17 | 1,24,971.76 | 1,06,602.86 | 91,737.6 | 74,230.06 | 67,025.06 |

| Sundry Debtors | 0 | 0 | 0 | 0 | 0 | 185.8 | 0 | 0 | 0 | 0 |

| Cash and Bank Balance | 1,529.24 | 1,136.65 | 1,086.55 | 1,035.56 | 679.87 | 1,239.82 | 1,108.47 | 796.5 | 646.6 | 572.37 |

| Loans and Advances | 6,444.68 | 6,038.12 | 4,146.7 | 3,942.53 | 3,627.17 | 3,195.09 | 2,409.98 | 2,171.25 | 1,232.62 | 1,233.58 |

| Total Current Assets | 7,973.92 | 7,174.76 | 5,233.26 | 4,978.09 | 4,307.04 | 4,620.71 | 3,518.46 | 2,967.75 | 1,879.22 | 1,805.95 |

| Current Liabilities | 8,666.51 | 8,176.8 | 6,137.55 | 6,423.18 | 4,901.91 | 5,063.97 | 4,602.72 | 3,773.54 | 2,511.86 | 2,008.64 |

| Provisions | 111.23 | 126.23 | 91.16 | 92.72 | 75.02 | 58.49 | 43.67 | 46.55 | 41.48 | 33.11 |

| Total Current Liabilities & Provisions | 8,777.73 | 8,303.04 | 6,228.71 | 6,515.9 | 4,976.93 | 5,122.46 | 4,646.39 | 3,820.1 | 2,553.34 | 2,041.75 |

| Net Current Assets | -803.81 | -1,128.27 | -995.45 | -1,537.81 | -669.89 | -501.75 | -1,127.93 | -852.35 | -674.12 | -235.8 |

| Other Assets | 1,897.22 | 1,585.31 | 642.83 | 424.05 | 299.05 | 79.59 | 0 | 0 | 0 | 0 |

| Total Assets | 2,93,729.33 | 2,39,619.15 | 2,04,160.54 | 1,73,065.83 | 1,27,185.46 | 1,24,882.9 | 1,05,835.07 | 91,286.02 | 73,995.35 | 67,266.8 |

| Contingent Liabilities | 2,131 | 908.3 | 1,082.34 | 1,853.91 | 2,188.49 | 1,533.78 | 827.56 | 665.6 | 100.14 | 176.05 |

Cash Flow (Figures in Rs. Crores)

| Direct Taxes Paid | 1,391.55 |

| Total Adjustments(Cash Generat... | 10,721.35 |

| Cash Flow before Extraordinary... | 10,721.35 |

| Net Cash from Operating Activi... | 10,721.35 |

| Purchased of Fixed Assets | -135.95 |

| Sale of Fixed Assets | 1.61 |

| Purchase of Investments | -1,27,357.92 |

| Sale of Investments | 91,423.8 |

| Net Cash used in Investing Act... | -13,613.68 |

| Proceeds from Issue of shares ... | 73.7 |

| Interest Paid | -477.09 |

| Net Cash used in Financing Act... | -403.38 |

| Direct Taxes Paid | 1,394.87 |

| Total Adjustments(Cash Generat... | 10,725.18 |

| Cash Flow before Extraordinary... | 10,725.18 |

| Net Cash from Operating Activi... | 10,725.18 |

| Purchased of Fixed Assets | -132.6 |

| Sale of Fixed Assets | 1.51 |

| Purchase of Investments | -1,27,285.07 |

| Sale of Investments | 91,348.85 |

| Net Cash used in Investing Act... | -13,631.77 |

| Proceeds from Issue of shares ... | 73.7 |

| Interest Paid | -477.09 |

| Net Cash used in Financing Act... | -403.38 |

Company Details

Registered Office |

|

| Address | 13th Floor Lodha Excelus, ApolloMills Compound Mahalaxmi |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400011 |

| Tel. No. | 91-22-67516666 |

| Fax. No. | 91-22-67516861 |

| investor.service@hdfclife.com | |

| Internet | http://www.hdfclife.com |

Registrars |

|

| Address | 13th Floor Lodha Excelus |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400011 |

| Tel. No. | 91-22-67516666 |

| Fax. No. | 91-22-67516861 |

| investor.service@hdfclife.com | |

| Internet | http://www.hdfclife.com |

Management |

|

| Name | Designation |

| Keki Mistry. | Chairman (Non-Executive) |

| Sumit Bose | Independent Director |

| Ketan Dalal | Independent Director |

| Vibha Padalkar | Managing Director & CEO |

| Narendra Gangan | Company Sec. & Compli. Officer |

| Bharti Gupta Ramola | Independent Director |

| Bhaskar Ghosh | Independent Director |

| Niraj Shah | Whole Time Director & CFO |

| Kaizad Bharucha | Non Executive Director |

| Venkatraman Srinivasan | Independent Director |

| Subodh Kumar Jaiswal | Independent Director |